Take advantage of the tax benefits of digital fuel receipts in the new year

Now is the perfect time to make your tax processes more efficient and utilise new, digital solutions. Digital fuel receipts are an easy way to do this. Not only do they save time, they also make organization easier and reduce paper chaos. Your receipts are securely stored and always at hand – perfect for your tax return! With the PACE Drive app, you can benefit directly from this advantage and manage your fuel receipts digitally.

Legal basis for digital receipts

Digital receipts such as fuel invoices have long been recognised for tax purposes, provided they comply with the requirements of the GoBD (principles for the proper keeping and storage of books, records and documents in electronic form). In plain language, this means that receipts must be unalterable, legible and traceable at all times. This ensures your digital receipts are just as secure and legally valid as traditional paper ones.

The PACE Drive app makes it easy to fulfill these requirements. Every fuel receipt is stored digitally and remains securely archived in the app – accessible at any time and perfectly prepared for your tax return. This not only saves you from collecting paper receipts, but you can also be sure that all tax requirements are met. You can download the app now for free from the Google Play Store or Apple App Store.

Advantages of digital fuel receipts in the new year

Switching to digital fuel receipts has many advantages, which will be particularly noticeable in the new year for your next tax return. Firstly, you save valuable time: instead of laboriously collecting, sorting and storing receipts, they are archived digitally, making it easier to collect them and attach them to your tax return. Secondly, you no longer need to keep physical receipts, which saves space and minimizes the risk of not being able to submit all relevant receipts.

Digital fuel receipts with the PACE Drive app

The PACE Drive app makes managing your fuel receipts easier than ever. After each refueling process, the receipts are automatically saved digitally and can be retrieved at any time. This not only eliminates the need for paperwork, but also the effort of manually sorting or archiving receipts. Receiving the digital receipt also confirms that the payment process has been successfully completed.

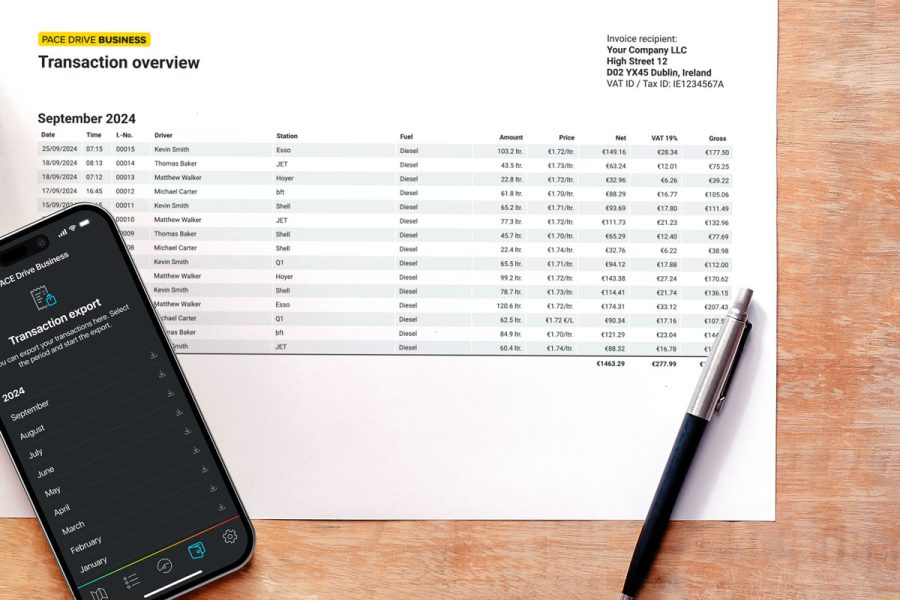

The app also offers practical additional functions: It shows you all saved receipts in a clear history and allows you to export them for your tax return or accounting. Thanks to GoBD-compliant storage, all digital fuel receipts fulfill the legal requirements and are therefore ideal for private individuals, the self-employed and companies who want to make their processes more efficient in the new year.

Integration of digital fuel receipts into accounting

The digitization of fuel receipts makes integration into modern accounting systems much easier. By automatically capturing and storing digital receipts, they can be seamlessly imported into accounting software, reducing manual effort and minimizing the error rate. This leads to more efficient processing of operating expenses and faster preparation of financial reports.

Advantages for companies with fleets

For companies with company cars or entire fleets of vehicles, digital fuel receipts offer enormous added value. Manually managing and invoicing refueling costs for multiple vehicles can be time-consuming and prone to errors. Digital receipts provide a remedy here by automating the entire process and making it clearer.

With the PACE Drive app, fleet managers even have access to the PACE Drive Business function. Not only can all fuel receipts be stored digitally, but all employee transactions can also be tracked, preferred payment methods assigned and company processes optimized.

More convenience for the self-employed

Self-employed people often face the challenge of documenting their business expenses accurately, especially when it comes to tax returns. Fuel receipts are among the most frequent and at the same time most time-consuming receipts, as they occur regularly and need to be well organized. That’s why using the PACE Drive app to keep fuel receipts organized really pays off.